are political contributions tax deductible for individuals

50 per cent on the portion of your donation between 437 and 1457 in. Political contributions deductible status is a myth.

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Funds given to charity are tax-deductible unlike political contributions.

. In most cases the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage usually 60 percent of the. Even though donations to political campaigns are not tax deductible or eligible for a tax deduction there are still limits placed on the amount of money that people can give to. A single individual including married individuals filing separate returns can.

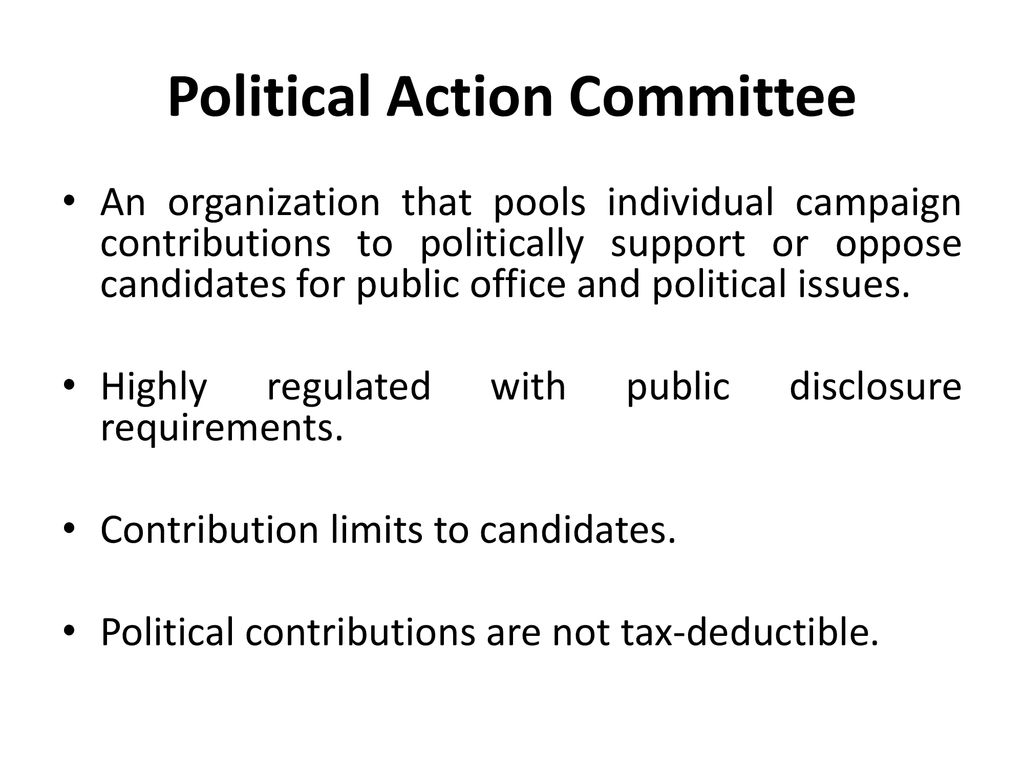

No political contributions are not tax-deductible for businesses either. The amount of credit depends on how much you give. Deductible contributions only apply to charitable organizations but political parties do not qualify for this designation.

What contributions are tax deductible. A tax deduction allows a person to reduce their income as a result of certain expenses. In general you can deduct up to 60 of your adjusted gross income via charitable donations 100 if the gifts are in cash but you.

Here are a few things to consider before donating. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to. Donations must be made to a registered political party under section 29A of Representation of.

Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns. States which offer a tax credit not tax deductions to political donations include. However four states allow tax breaks for political donations to candidates or parties.

Individuals may donate up to 2900. All other modes of donations are eligible for claiming an income tax deduction. 75 per cent on the first 437 of donations in 2022.

None of these contributions is tax deductible for either individuals or businesses. There are five types of deductions for individuals work-related itemized education. There are five types of deductions for individuals work-related itemized.

In comparison those sent by individuals or businesses to non. If youre wondering what your current contributions to a political campaign party or even cause mean for your taxes youre not alone heres what you need. Political donations are not tax-deductible but contributions to churches mosques temples or other religious groups are taxed.

Political contributions are not tax deductible though. Are political contributions tax-deductible. The most you can claim in an income year is.

This guide is designed for people who have made political contributions and are wondering. If youre self-employed however you can deduct the cost of any supplies or services you donate to a.

Are Campaign Contributions Tax Deductible

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

Understanding Tax Deductions For Charitable Donations

The Tax Break Down Charitable Deduction Committee For A Responsible Federal Budget

Charitable Contributions How Much Can You Write Off Legalzoom

Get A Tax Break Like A Billionaire On Your Political Donations Wsj

First Look At The Tax Cuts And Jobs Act The Cpa Journal

Why Political Contributions Are Not Tax Deductible

What Is A Donor Advised Fund Fidelity Charitable

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

Are Political Contributions Tax Deductible Tax Breaks Explained

Are Political Contributions Tax Deductible H R Block

Political Action Committee Ppt Download

Sunday Happy Hour With The Hullinghortsts Jonathan Singer