oregon estimated tax payment voucher 2021

June 15 2022 3rd payment. You expect your withholding and refundable credits to be less than the smaller of.

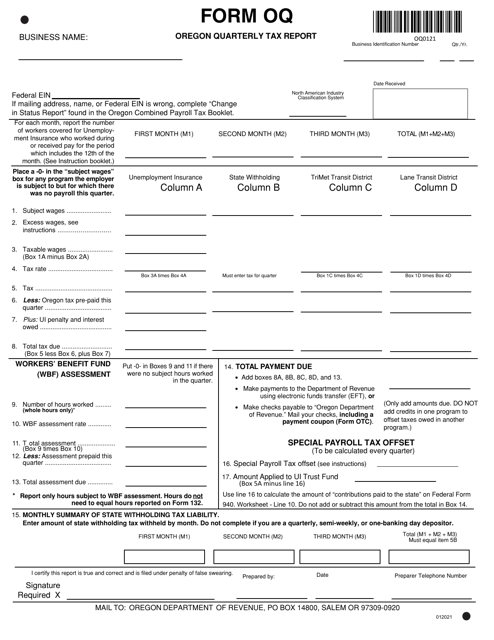

Form Oq Download Fillable Pdf Or Fill Online Oregon Quarterly Tax Report Oregon Templateroller

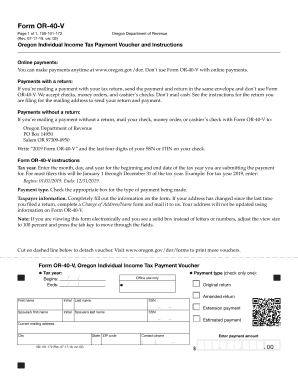

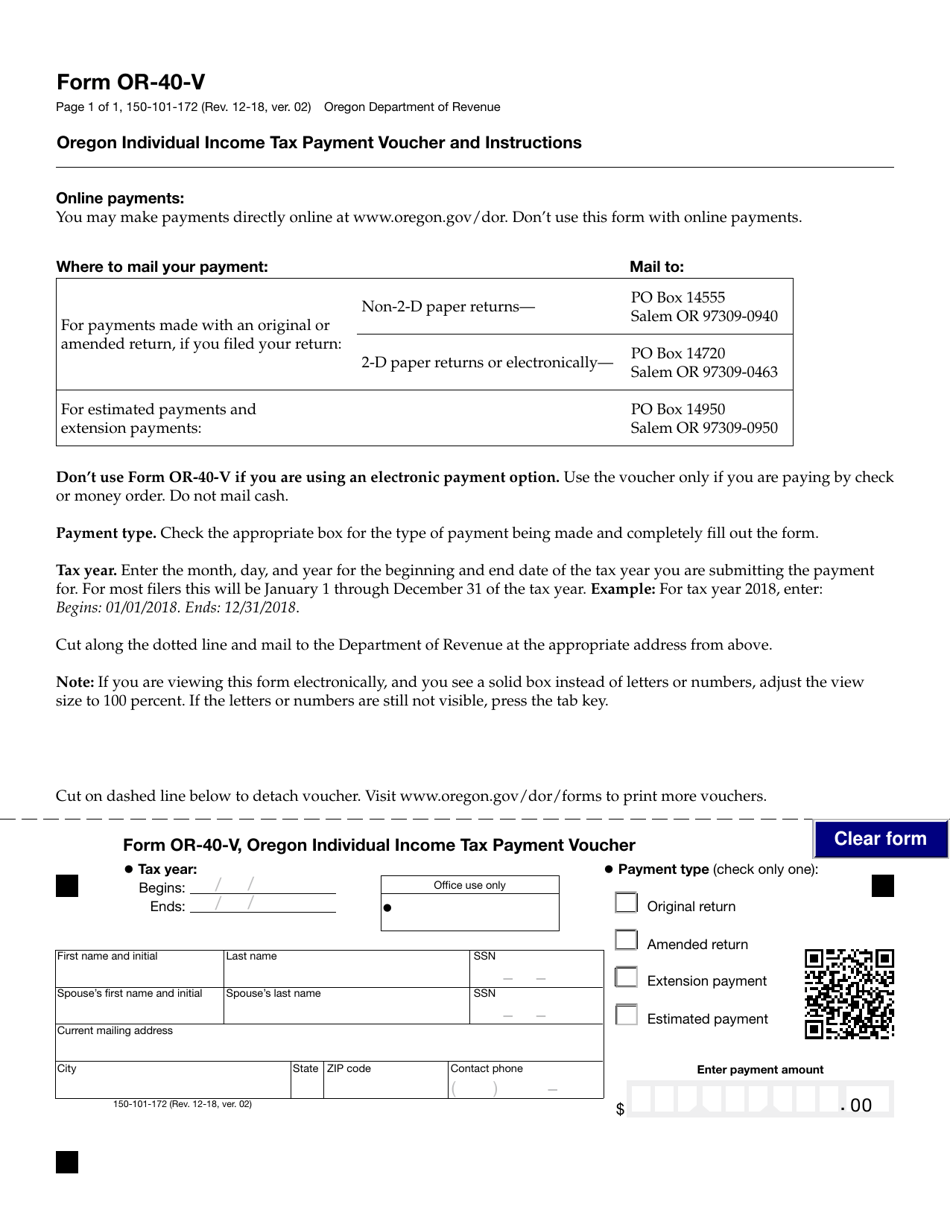

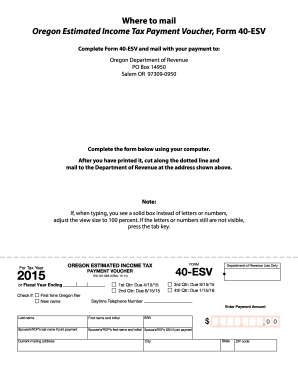

More about the Oregon Form 40-V Individual Income Tax Voucher TY 2021.

. Call at least 48 hours in advance 503 945-8050. For more information see Form OR-40-V Instructions. April 18 2022 2nd payment.

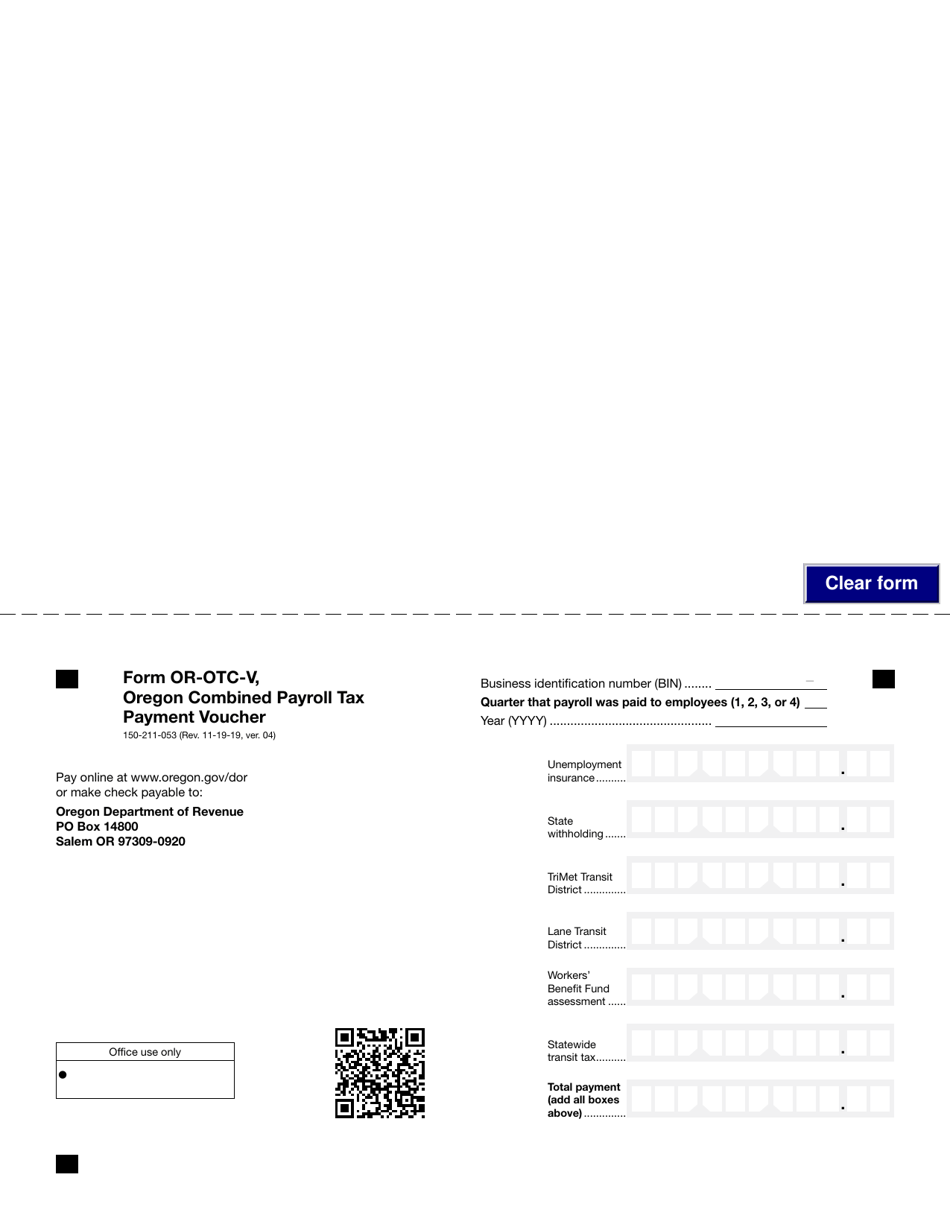

Form OR-QUP-CAT Underpayment of Oregon Corporate Activity Estimated Tax. Annual withholding tax reconciliation reports Form WR with payment or deposit. Oregon Marijuana Tax Oregon Department of Revenue PO Box 14630 Salem OR 97309-5050.

How do I pay my estimated taxes in Oregon. Find options at wwworegongovdor. Combined Payroll and Withholding.

Use this voucher only if you are making a payment without a return. CITY OF OREGON TAX DEPT 5330 SEAMAN ROAD OREGON OH 43616 SSFED. Publication OR-CAT-BRO Corporate Activity Tax Brochure.

You expect to owe at least 1000 in tax for 2021 after subtracting your withholding and refundable credits. Form OR-CAT-V Oregon Corporate Activity Tax Payment Voucher Instructions. Cash payments must be made at our Salem headquarters located at.

These individuals can take credit only for the estimated tax payments that they made. We last updated the Payment Voucher for Income Tax in January 2022 so this is the latest version of Form 40-V fully updated for tax year 2021. Mail the voucher and payment.

An estate of a domestic decedent or a domestic trust that had a full 12-month 2021 tax year and had no tax liability for that year. Write Form OR-20-V the filers name federal employer identification number FEIN the tax year beginning and ending dates and a daytime phone on your payment. Use this voucher only if you are making a payment without a return.

Ad Download Or Email Form 40-ESV More Fillable Forms Register and Subscribe Now. Use this payment voucher to file any payments that you need to make with your Oregon income taxes. 4 million Oct 04 2021 A single ticket sold in California matched all six numbers drawn Monday and was the lucky winner of a Powerball jackpot of nearly 0 million officials said.

Retirees If youre retired or will retire in 2022 you may need to make estimated tax payments or have Oregon income tax withheld. Ad Download Or Email Form 40-ESV More Fillable Forms Register and Subscribe Now. Fill Oregon Estimated Tax Payment.

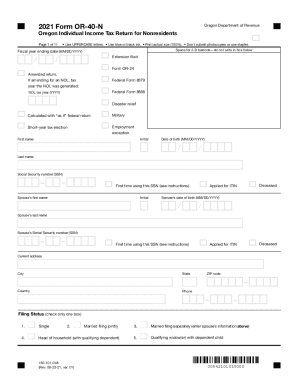

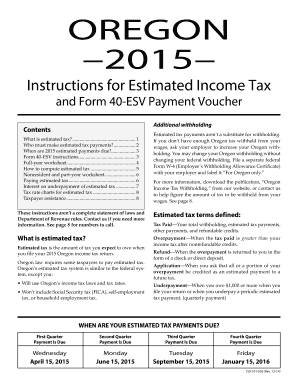

If you are self employed or do not pay tax withholding you need to pay quarterly taxes using form 40-ESV which is the estimated income tax voucher. Form 40 is the general income tax return for Oregon residents. This form is for income earned in tax year 2021 with tax returns due in April 2022.

Oregon may also allow you to e-file your Form 40-V instead of mailing in a hard copy which could result in your forms being received and processed faster. 100 of the tax shown on your 2020 tax return. Salem OR 97309-0920.

We will update this page with a new version of the form for 2023 as soon as it is made available by the Oregon government. Make your check money order or cashiers check payable to the Oregon Department of Revenue. Dec 10 2021 The holder of the highest-paying lottery ticket in California history has come forward to claim his winnings from the Oct.

Form 40 can be eFiled or a paper copy can be filed via mail. Make your check money order or cashiers check payable to the Oregon Department of Revenue. Write Form OR-40-V your daytime phone the last four digits.

Learn more about marijuana tax requirements. You can pay all of your estimated tax by April 18 2022 or in four equal amounts by the dates shown below. Other Oregon Individual Income Tax Forms.

How To Send in Your 2021 Tax Return Payment and Form 1040-V Dont staple or otherwise attach your payment or Form 1040-V to your return or to each other. Oregon estimated income tax payment due dates are the same as the federal Form 1040-ES payment due dates. Make joint estimated tax payments.

You can still make estimated tax payments even if you expect that your tax after all credits will be less than 1000. Estimated tax payments arent required from. Enter your 2-character special condition code if applicable see instr.

WHEN TO FILE Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2021. We last updated Oregon Form 40-ESV in January 2022 from the Oregon Department of Revenue. Instead just put them loose in the envelope.

Mail check or money order with voucher to. CITY OF OREGON ESTIMATED TAX 2021 CALENDAR YEAR DUE APRIL 15 2021 FISCAL YEAR 15TH DAY OF THE 4TH MONTH OF TAXABLE YEAR MAKE CHECK PAYABLE TOCOMMISSIONER OF TAXATION MAIL TO. 90 of the tax to be shown on your 2021 tax return or b.

Where can I get Oregon tax forms. 2021 Personal Income Tax Forms. D your expected estimated tax liability exceeds your withholding and tax credits by 150 or less.

Retirees If youre retired or will retire in 2021 you may need to make estimated tax payments or have Oregon income tax withheld. You can still make estimated tax payments even if you expect that your tax after all credits will be less than 1000. For more information about the Oregon Income Tax see the Oregon Income Tax page.

For the 2021 tax year estimated tax payments are due quarterly on the following dates. Cigarette tax stamp orders. Estimated payment Want to make your payment online.

Use this instruction booklet to help you fill out and file your vouchers. Mail your 2021 tax return payment and Form 1040-V to the address shown on the back that applies to you. Estimated income tax payments must be made in full on or before May 1 2021 or in equal installments on or before May 1 2021 June 15.

ID Quarterly Estimated Payment From Line 8 of. And Jan 15 2022. Form OR-CAT-V Oregon Corporate Activity Tax Payment Voucher.

To make estimated tax payments to avoid a penalty even if it didnt include household employment taxes when figuring its estimated tax.

2020 2022 Form Or Or 40 V Fill Online Printable Fillable Blank Pdffiller

Oregon Tax Forms 2021 Printable State Form Or 40 And Form Or 40 Instructions

2020 2022 Form Or Or 40 V Fill Online Printable Fillable Blank Pdffiller

2021 W 4 Form Oregon Fill And Sign Printable Template Online Us Legal Forms

Oregon Estimated Tax Payment Voucher 2021 Fill Online Printable Fillable Blank Pdffiller

Get And Sign Fillable Online Oregon Clear Form Oregon Amended Return 2021 2022

Form 50 101 172 Or 40 V Download Fillable Pdf Or Fill Online Oregon Individual Income Tax Payment Voucher 2018 Templateroller

Fill Free Fillable Forms For The State Of Oregon

Solved Eip And Impact On State Taxes

Oregon Estimated Tax Payment Voucher 2021 Fill Online Printable Fillable Blank Pdffiller

Form Or Otc V 150 211 053 Download Fillable Pdf Or Fill Online Oregon Combined Payroll Tax Payment Voucher 2019 Templateroller

Get And Sign Oregon Estimated Tax Payment Voucher 2015 2022 Form

Oregon Form 40 Esv Estimated Income Tax Payment Voucher 2021 Oregon Taxformfinder